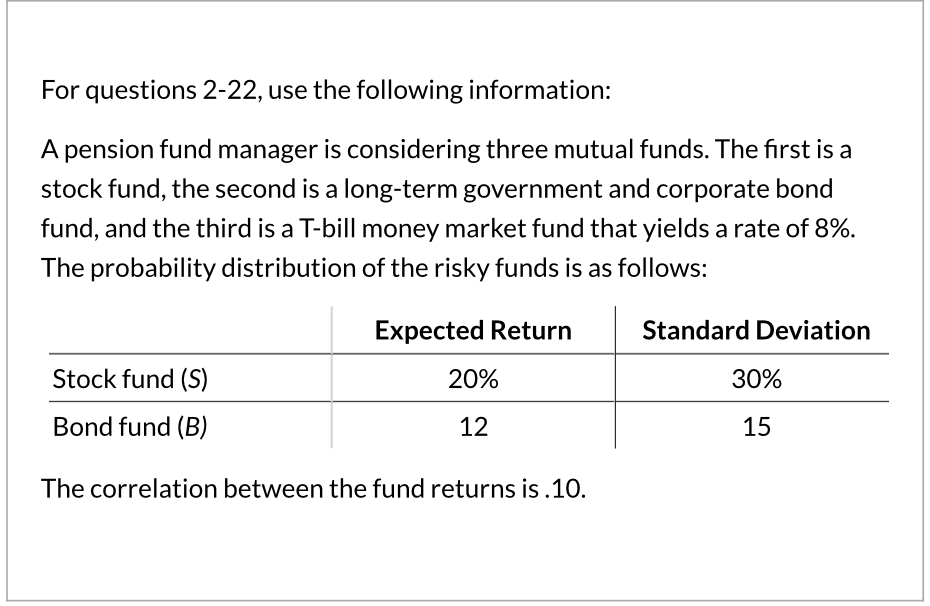

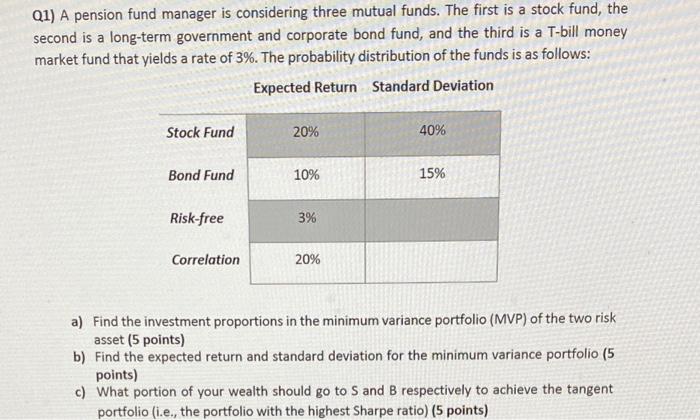

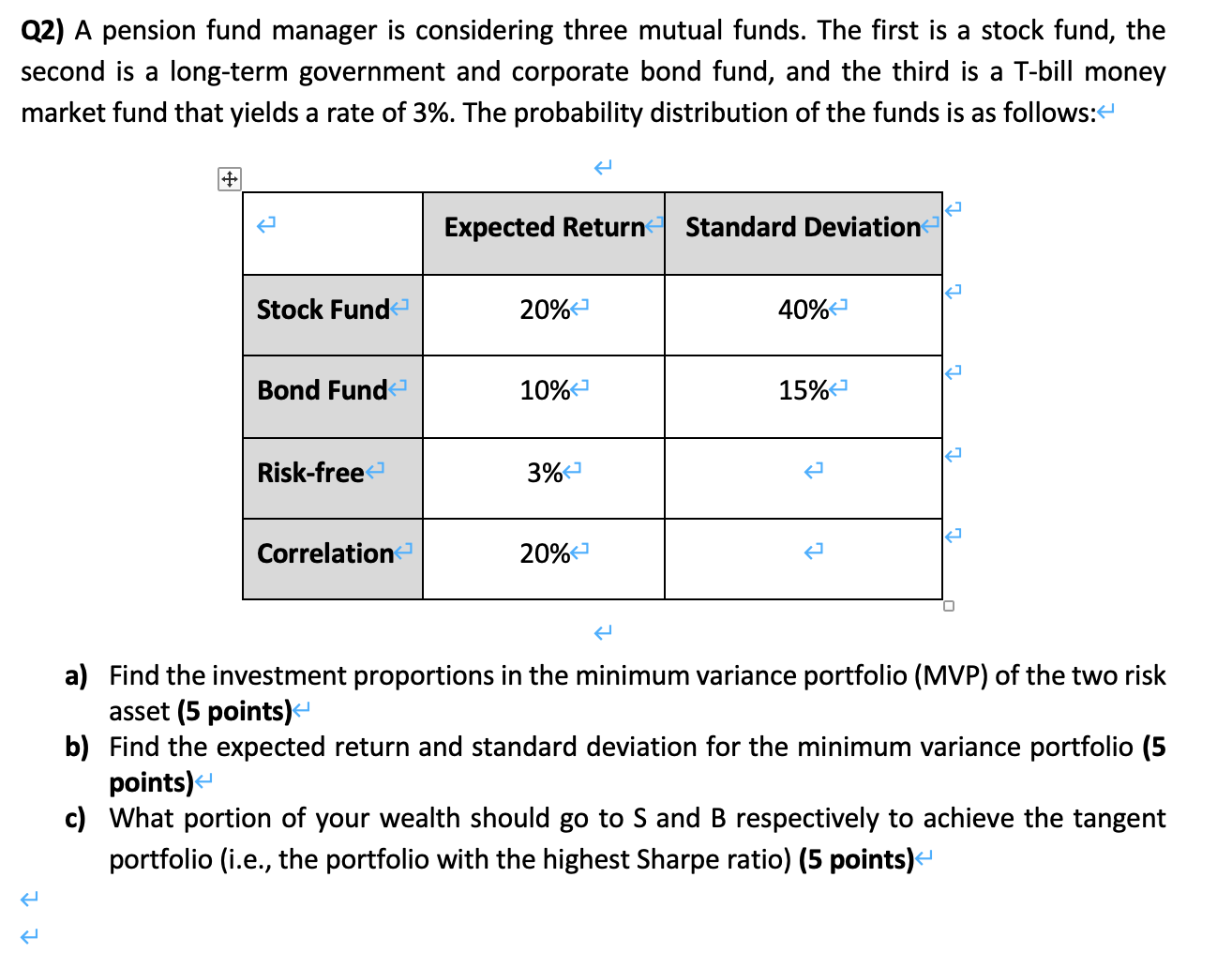

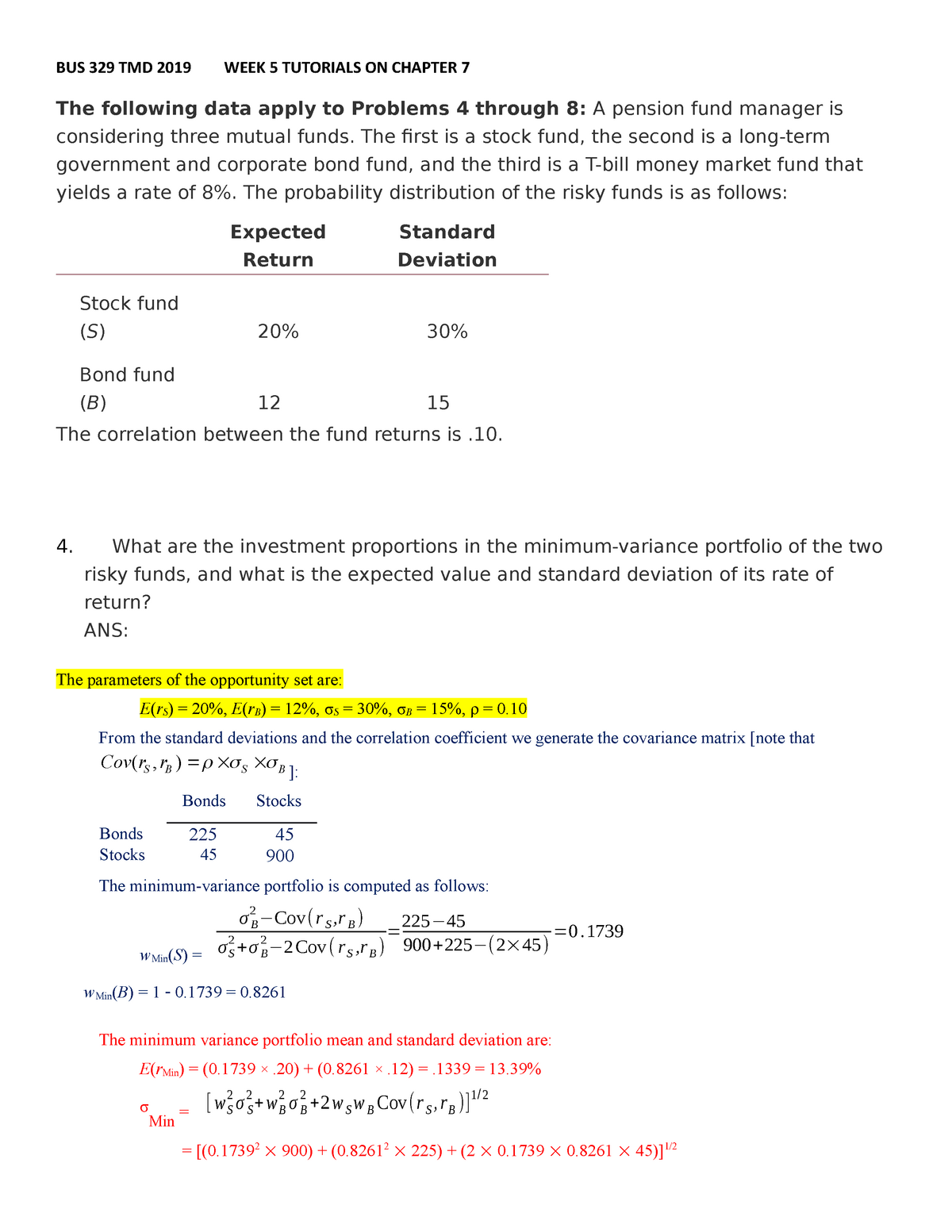

Topic 7 Q & S - stuuf - BUS 329 TMD 2019 WEEK 5 TUTORIALS ON CHAPTER 7 The following data apply to - StuDocu

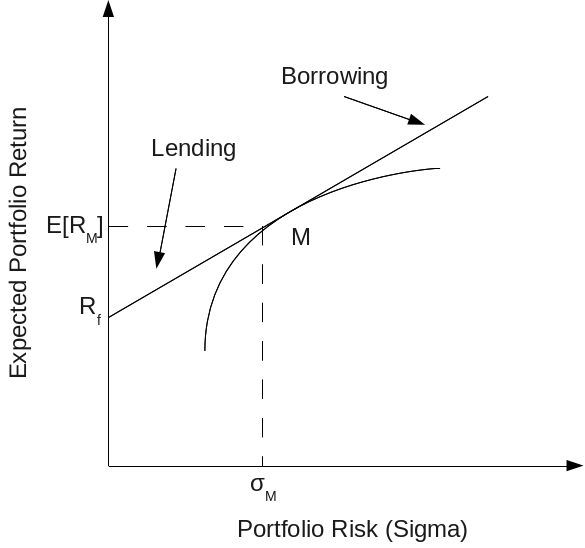

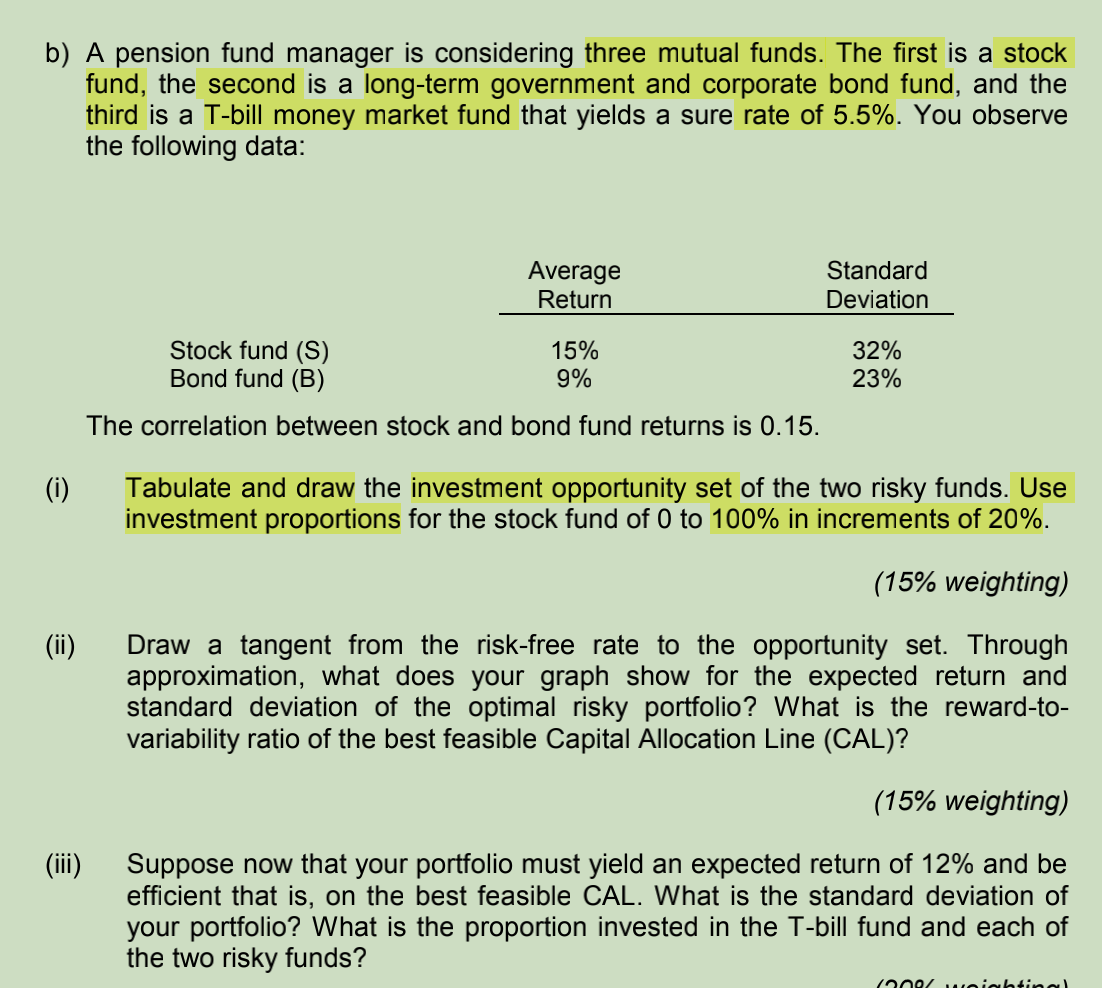

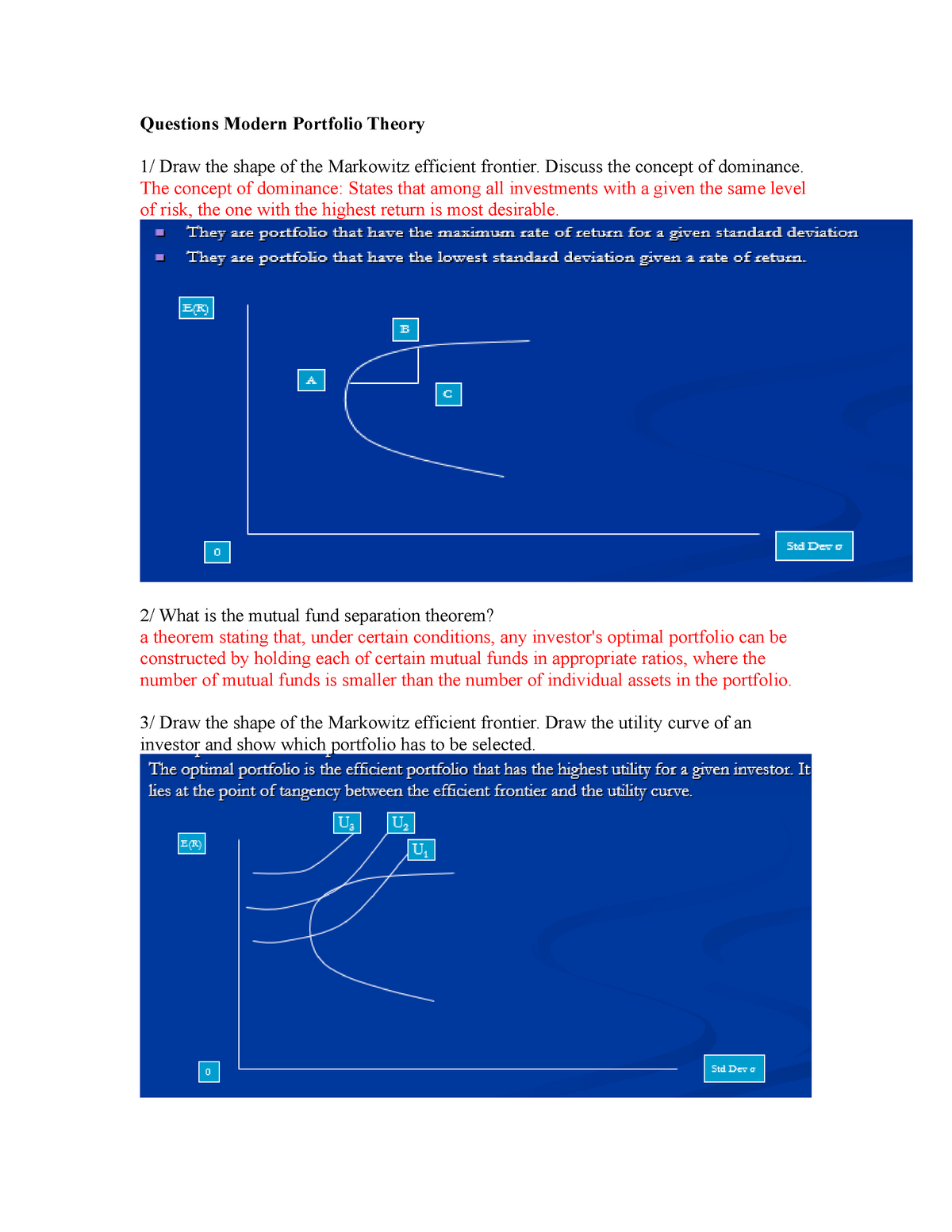

3Modern Portfolio Theory - Discuss the concept of dominance. The concept of dominance: States that - StuDocu

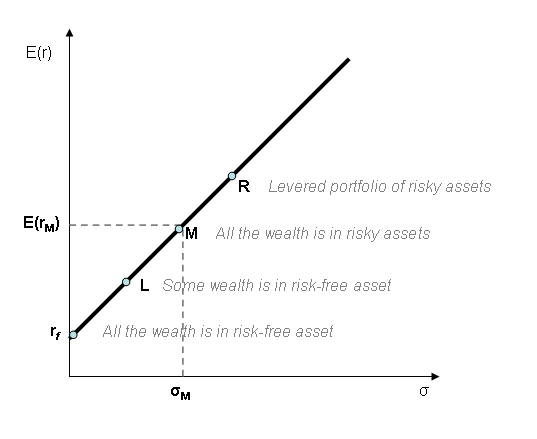

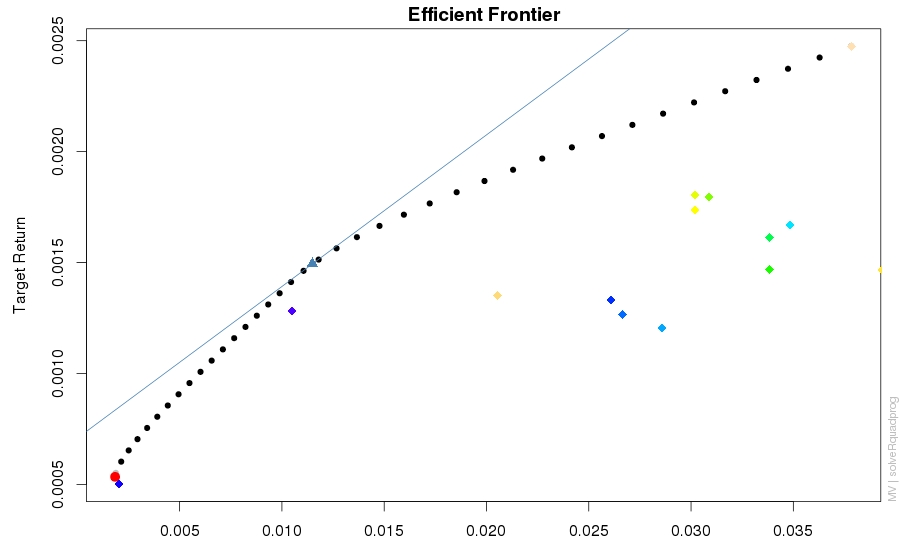

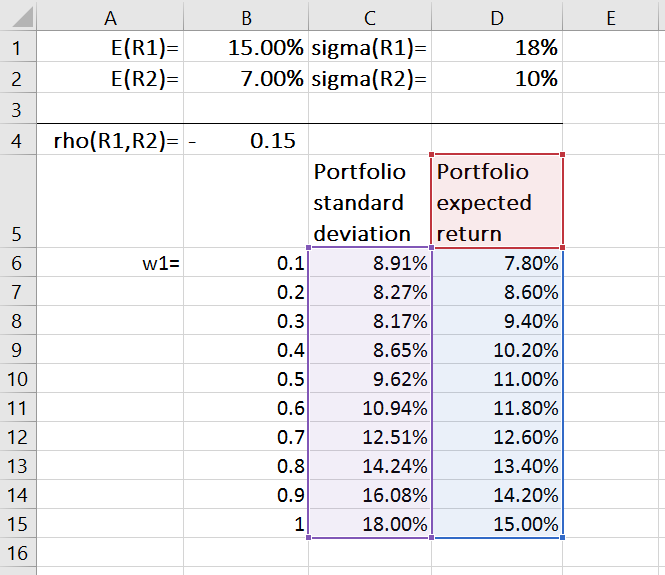

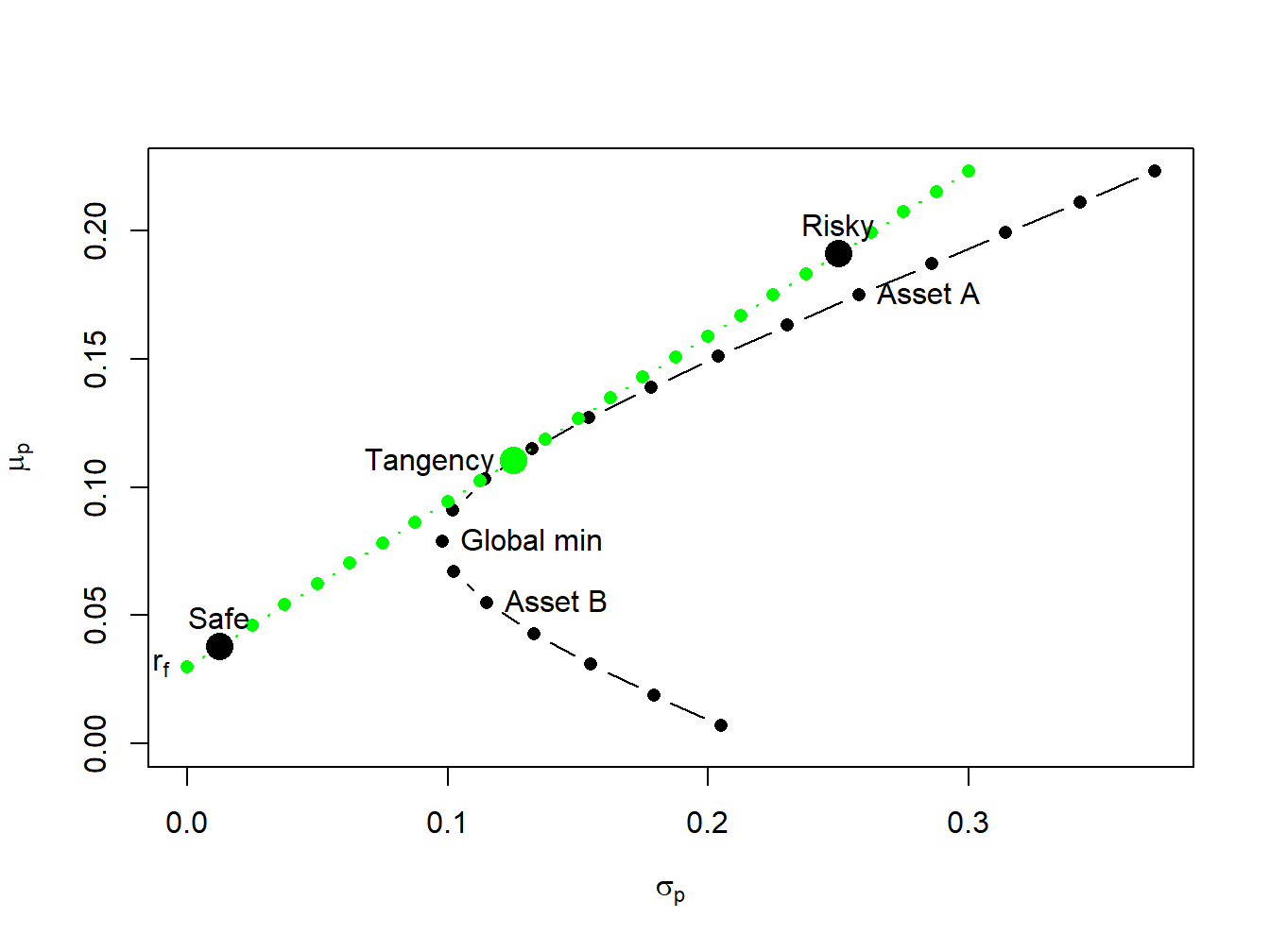

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

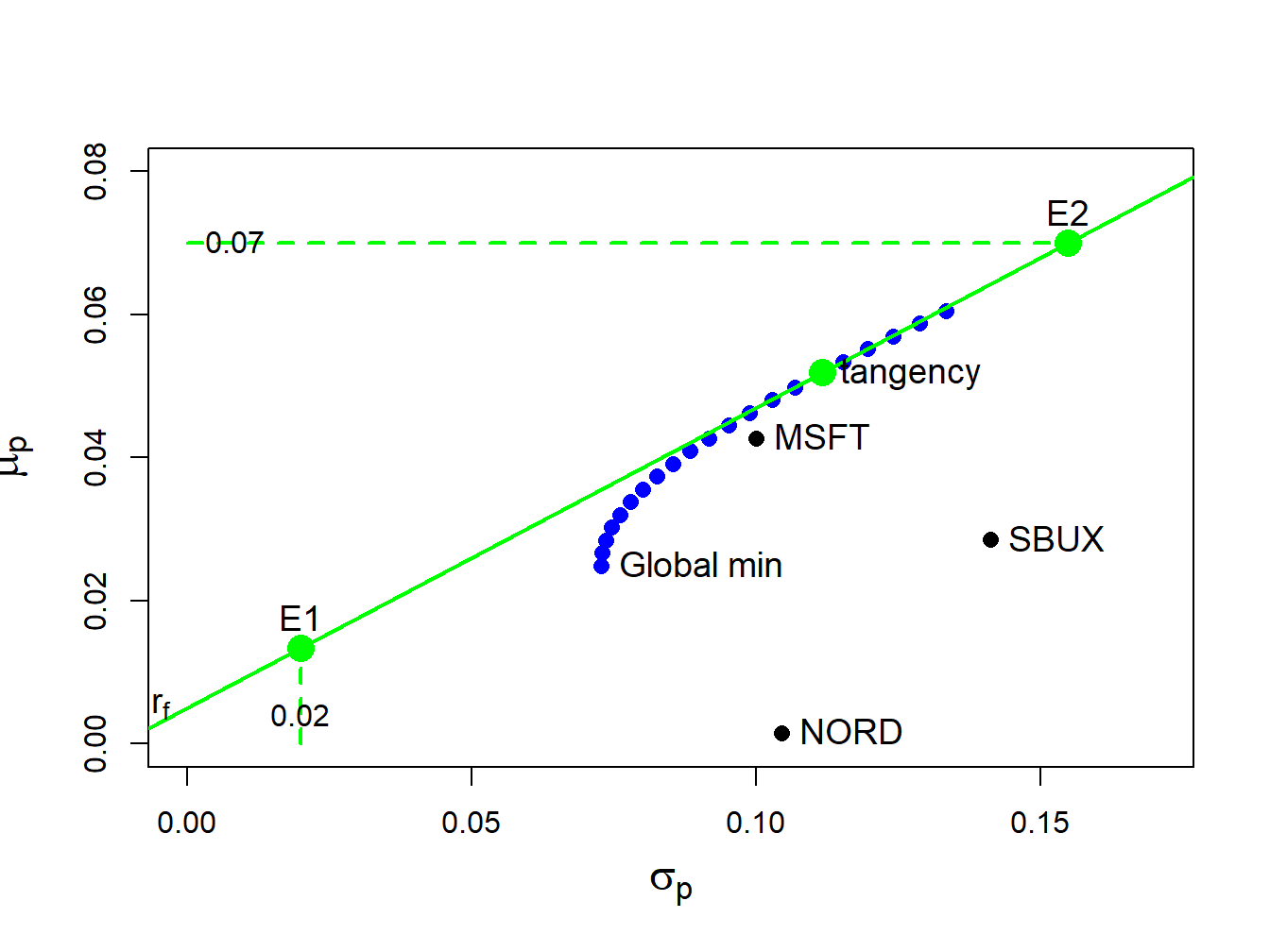

12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

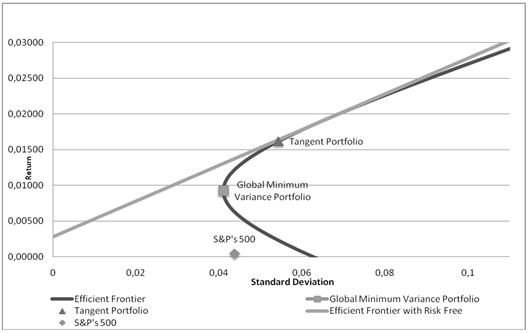

Portfolio Allocation: An Empirical Analysis of Ten American Stocks for the Period 2010-2015 :: Science Publishing Group